How to Invest in Neuralink Stock Before Its IPO

Neuralink is developing implantable computer chips for the brain, known as brain-computer interfaces (BCIs). The man behind it: Elon Musk.

Neuralink's devices have the potential to treat people who have disabilities of the brain and spine, such as blindness, deafness, memory loss, paralysis, and more.

And the tech isn't just theoretical.

Thanks to one of Neuralink's coin-sized brain chips, one quadriplegic U.S. military veteran can now play video games, control electronics, and even design 3D objects using only his thoughts. He is one of twelve such patients with a Neuralink implant.

Musk's vision for the technology goes far beyond medical applications. He believes the devices will “unlock human potential” by linking our brains with the internet, artificial intelligence, and other technologies.

And, if you qualify as an accredited investor, there's a way for you to invest in Neuralink right now — even though it's still a private company.

Can you buy Neuralink stock?

Neuralink is a private company, which means it is not a publicly traded stock — you cannot purchase shares of it in your regular brokerage account.

There is no Neuralink stock symbol, and the company has made no indication of an IPO in the near future.

Given the star power of the founding team, Neuralink has had no problem raising capital from private equity investors and venture capitalists.

To date, the company has raised $1.29 billion from investors, including a fresh $650 million round in May 2025 at a $9 billion valuation.

And you may be able to invest right alongside them.

How to Buy Neuralink Stock

Hiive is an investment marketplace where accredited investors can buy shares of pre-IPO, private companies.

Accreditation requirements

To qualify as an accredited investor, you must meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000, excluding your main residence.

- Be a qualifying financial professional.

On Hiive, accredited investors can buy shares of private, VC-backed startups. There are hundreds of companies listed on Hiive, including SpaceX, Databricks, and Neuralink:

As of the time of this writing, there are 23 orders of Neuralink stock available on Hiive.

These listings are from different sellers who have various asking prices and volumes offered. Sellers may be current or former employees, venture capitalists, or angel investors.

On Hiive, buyers can either accept asking prices or place bids and negotiate directly with the sellers.

Register for Hiive and see the volume and asking prices offered for Neuralink stock:

The ARK Venture Fund

While buying shares on Hiive will give you direct exposure to Neuralink, investing in the ARK Venture Fund will also give you exposure to the company — and it's available to both accredited and retail investors.

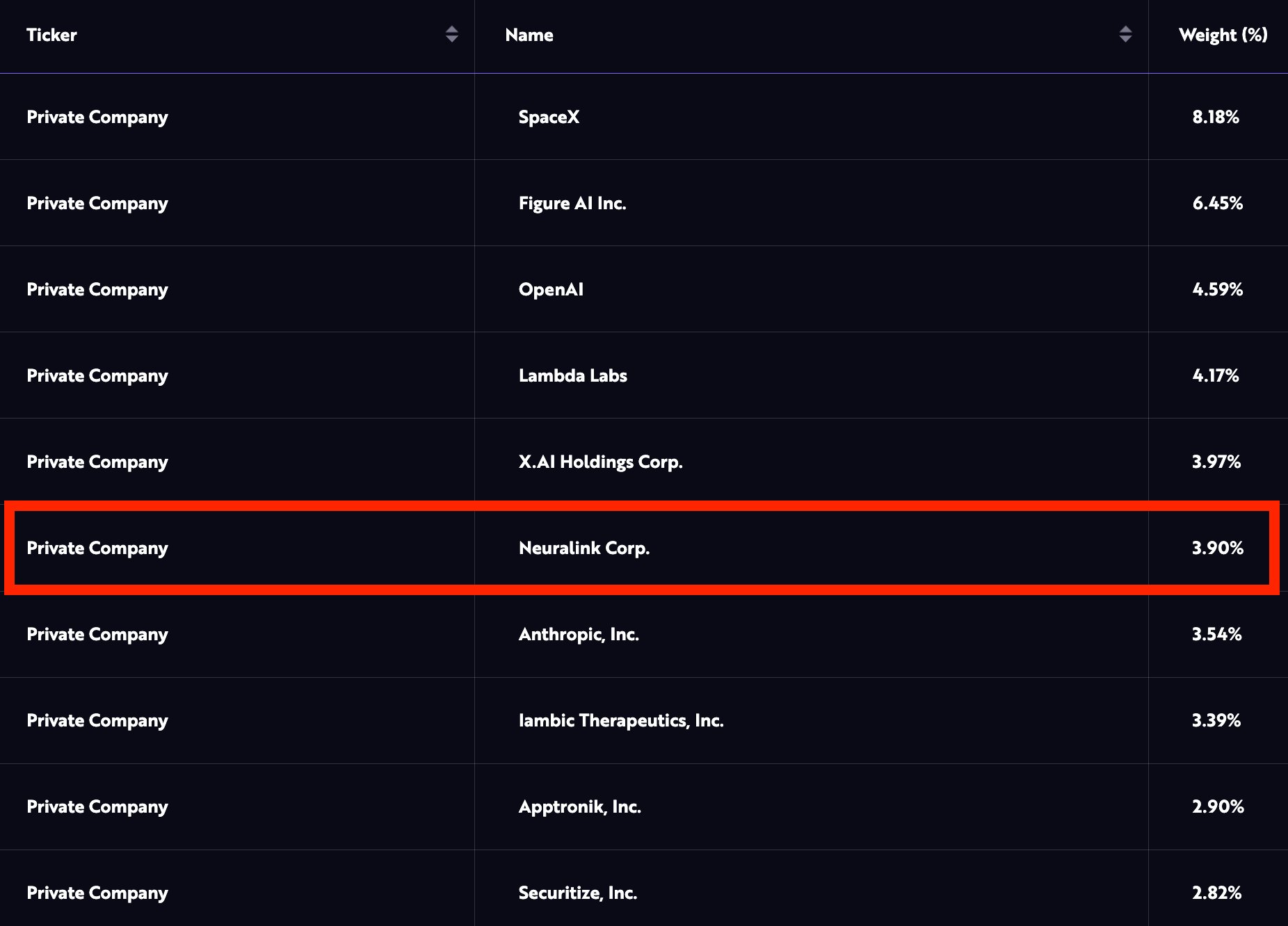

The ARK Venture Fund owns a portfolio of many of the world's most disruptive technology companies, including Neuralink, which is currently the fund's sixth-largest position:

The ARK Venture Fund was a key investor in Neuralink's May 2025 round, which significantly boosted its stake in the company.

The fund also owns stakes in Musk's other privately-held companies: SpaceX, xAI, and The Boring Company. OpenAI and Anthropic are also in its top 10 holdings.

The fund has an annual management fee of 2.90%. You can get more information about how to invest on ARK's website.

Publicly traded competitors

You may also be interested in investing in one of Neuralink's publicly traded competitors.

Note: While I've listed these as competitors, none are publicly working on general-purpose brain-computer interfaces (aka BCIs) that rival Neuralink's.

- NeuroPace (NPCE): NeuroPace is a commercial-stage neuromodulation company best known for its FDA-approved implantable device that detects and responds to abnormal brain activity in epilepsy patients. It's one of the closest public proxies for Neuralink, though its technology focuses on therapeutic stimulation rather than high-bandwidth brain-computer interfaces.

- NeuroOne Medical Technologies (NMTC): NeuroOne develops ultra-thin film electrodes used for recording brain signals and delivering targeted stimulation. Its work overlaps with the electrode-array side of Neuralink's platform, but it doesn't build complete BCI implants.

- Medtronic (MDT): Medtronic is a global leader in implantable medical devices, with its neuromodulation unit mainly focusing on deep-brain stimulation systems for Parkinson's and other neurological disorders. Its neurostimulation products serve similar therapeutic goals but aren't designed for the high-resolution read/write interfaces Neuralink is targeting.

- Inspire Medical Systems (INSP): Inspire makes implantable neurostimulation devices for sleep apnea, using targeted nerve activation to maintain airway function. It's not a BCI company, but its FDA-approved implant platform is part of the growing field of smart neuromedical implants.

If you're looking for general exposure to biotechnology innovations, you may be interested in ARK Invest's Genomic Revolution ETF (ARKG), though the companies in this fund are working on genomics, not BCIs.

When will Neuralink IPO?

Neuralink has not filed any IPO documents with the SEC and has not mentioned any specific plans to go public.

By staying private, the company can take its time researching and making progress toward its lofty goals without the added pressure of having to answer to shareholders.

In my opinion, the company is unlikely to go public before it has a marketable product and a consistent stream of revenue. I would guess we'll hear about this on Musk's social media accounts before any official filings are made with the SEC.

When it does go public, the stock symbol might be something like LINK, NLNK, or NRLK (my ideas), and you'll need a brokerage account to buy shares.

If you don't have a brokerage account, we recommend Public. On Public, you can invest in stocks, ETFs, Treasuries, and cryptocurrencies — all in one place.

Who owns Neuralink?

Elon Musk initially invested $100 million in Neuralink back in 2016 and is likely still the largest shareholder.

Since then, the company has raised an additional ~$1.19 billion from a number of private investors and VC firms.

Most recently, the company raised $650 million in its Series E from ARK Invest, Sequoia Capital, DFJ Growth, Lightspeed, Founders Fund, G42, Human Capital, QIA, Thrive Capital, Valor Equity Partners, and Vy Capital, among others.

The round valued the company at $9 billion.

In addition to Musk, his two co-founders (Max Hodak and Paul Merolla), current CEO Jared Birchall, and a handful of early employees also likely own stakes in the company, though their exact stakes are unknown.

More about Neuralink

At its core, Neuralink is aiming to connect human brains with computers and the internet.

The Neuralink team describes its device, known as the "Link," as about the size of a large coin. It is implanted by a robotic system that manages the entire procedure.

The implant operation will cost around $5,000, and the hardware will cost about $200–$300.

After being implanted, you'll connect the device to your smartphone, keyboard, mouse, or other internet- or Bluetooth-enabled device.

Musk believes the Link will become as essential as a car — everyone will have one.

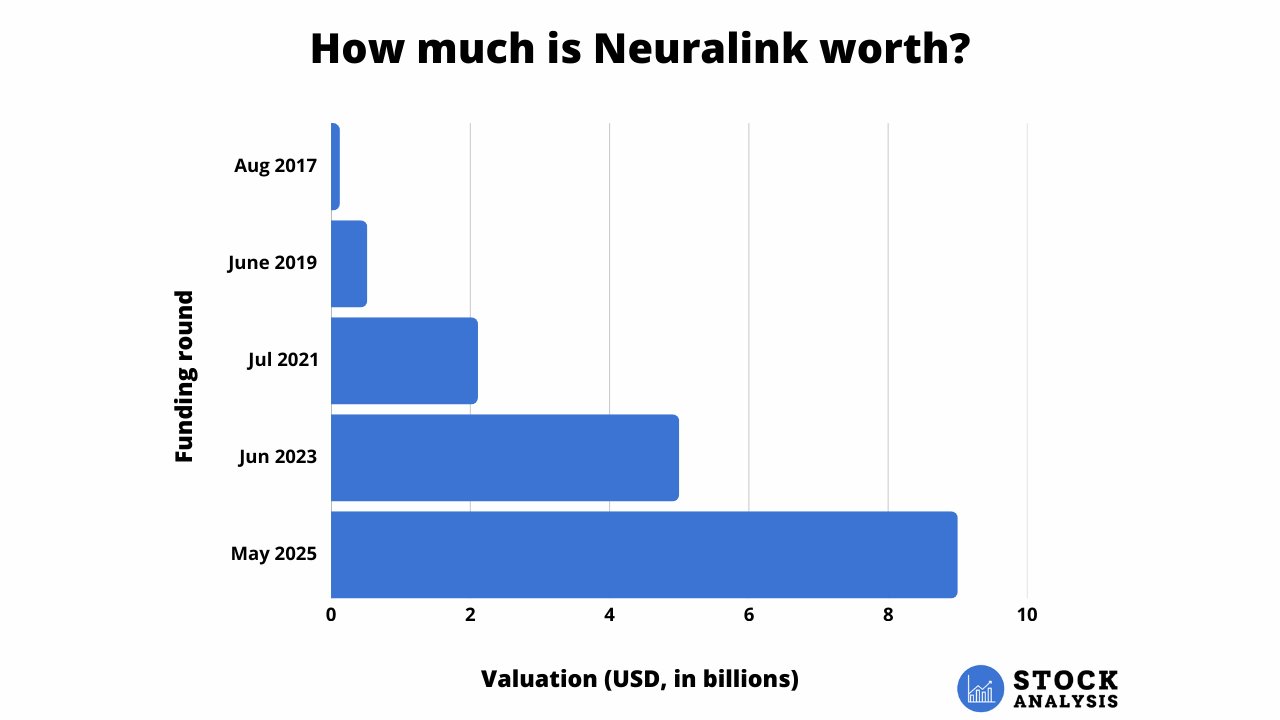

Neuralink valuation chart

Neuralink most recently raised $650 million at a $9 billion valuation in May 2025.

This was up 80% from the $5 billion valuation it received in June 2023.

Here's a look at how Neuralink's valuation has changed over time:

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited (“Hiive”) or any of its affiliates. Stock Analysis is not a broker dealer or investment adviser. This communication is for informational purposes only, and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investment involves risk, including the loss of principal and past performance does not guarantee future results. There is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and member of FINRA / SIPC. Find Hiive on BrokerCheck.

.png)